what percentage of taxes are taken out of paycheck in nc

Plus to make things even breezier there are no local income taxes. Total income taxes paid.

North Carolina Income Tax Calculator Smartasset

The Social Security tax is 62 percent of your total pay until you reach an annual income threshold.

. You pay 12 on the rest. New Federal Tax Withholding Tables were added to the Integrated HR-Payroll System last month and many of you are wondering if you need to change your withholding allowance. FICA contributions are shared between the employee and the employer.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. FICA taxes consist of Social Security and Medicare taxes. The state of North Carolina has an income tax rate of 549 percent for the 2018 tax year.

For Tax Years 2019 and 2020 the North Carolina individual income tax rate is 525 00525. Your employer will deduct three allowances you and two children at 21924 7308 times 3 from your pay to allow for your withholding allowances. What is NC income tax rate 2020.

The 2018 tables still utilize seven income tax brackets although the percentages have been adjusted as well as the amount of income that can be earned within each bracket. Actually you pay only 10 on the first 9950. Amount taken out of an average biweekly paycheck.

In 2021 the federal income tax rate tops out at 37. 27 rows North Carolina Paycheck Quick Facts. 655 an hourNO.

Section 96-92b Minimum UI Tax Rate. North Carolina income tax rate. North Carolina Payroll Taxes North Carolina payroll taxes are as easy as a walk along the outer banks.

Income Taxes When first hired at a job employees fill out several forms. You Should Never Say I Cant Afford That. I am a server in NC and most of the time I dont receive a paycheck but it all goes to taxes.

These amounts are paid by both employees and employers. Look at the tax brackets above to see the breakout Example 2. Where Do Americans Get Their Financial Advice.

Amount taken out of an average biweekly paycheck. Are taxes high in North Carolina. Employers Reserve Ratio Percentage ERRP Employers Reserve Ratio Multiplied by 068.

Federal income tax is usually the largest tax deduction from gross pay on a paycheck. Income taxes FICA and court ordered garnishments NCGS. However the 62 that you pay only applies to income up to the Social Security tax cap which for 2021 is 142800 up from 137700 in 2020.

The remaining amount is 68076. The IRS recently added a new Withholding Calculator to their website and encourages all employees to use the calculator to perform a quick paycheck checkup. Social Security tax and Medicare tax are two federal taxes deducted from your paycheck.

Section 96-92c UI Tax Rate for Beginning Employers. The percentage rate for the Medicare tax. For 2021 employees will pay 62 in Social Security on the first 142800 of wages.

A signed on or before the pay day in which the deduction will be made b includes the reason for the deduction and c states the actual dollar. NORTH CAROLINA With an effective rate of nearly 11 percent North Carolina ranks 22nd in the nation for state and local tax burden. Your federal income tax withholding is 11891.

There is a flat income tax rate of 499 which means no matter who you are or how much you make this is the rate that will be deducted. FICA taxes are commonly called the payroll tax however they dont include all taxes related to payroll. An employer withholds these funds from the paycheck as well as income taxes and other deductions.

Your employer then will multiply 68076 by 15 percent 10211 and add the 1680 base amount. Section 96-92c Mail Date for Unemployment Tax Rate Assignments For 2022. Calculate Medicare tax at 145 percent of your gross pay and Social Security tax at 62 percent.

Subtract state income tax federal income tax Social Security tax and Medicare tax as shown in Steps 1 2 and 3 from gross wages except if you have a pretax voluntary deduction such as a Section 125 health plan. Section 96-92c Maximum UI Tax Rate. It is 213 an hour.

Determine monthly take-home pay. Amount taken out of an average biweekly paycheck. In general rates have been lowered overall with the highest bracket dropping 26 percent from the previous year reducing the 396 percent rate to 37 percent.

Only the highest earners are subject to this percentage. One of these forms is a W-4 which dictates how much money. 62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62.

The more someone makes the more their income will be taxed as a percentage. My income is strictly tips. 95-258a2 - The amount of a proposed deduction is known and agreed upon in advance and the written authorization is.

December 15 2021 Final Date for Voluntary. However the 2019 tax year for taxes filed in 2020 taxpayers will see a reduction of this rate to 525. The 2017 Social Security withholdings total 124 percent and Medicare withholding rates total 29 percent according to the IRS.

The North Carolina bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Everything You Need To Know About Taxes This Year Rich Dad Poor Dad Author Robert Kiyosaki.

How Much Should I Set Aside For Taxes 1099

Group Finance Director Salary In Durham Nc Comparably

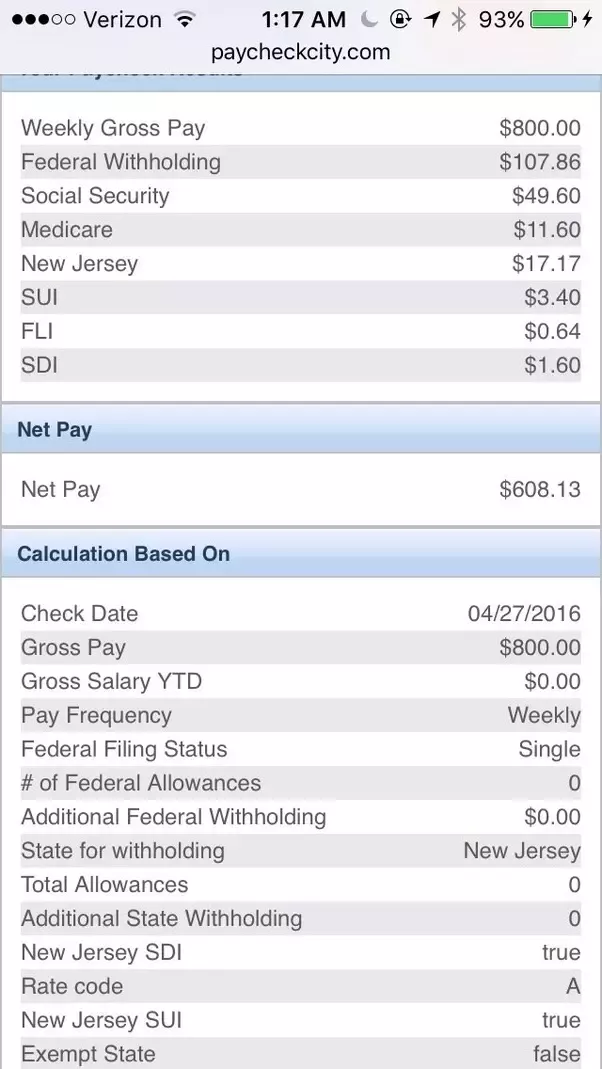

I Make 800 A Week How Much Will That Be After Taxes Quora

Tax Withholding For Pensions And Social Security Sensible Money

Here S How Much Money You Take Home From A 75 000 Salary

Why Did Tax Revenues Increase In Nc Other States During Pandemic Ncsu Texas Researcher Say Wral Techwire

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

North Carolina Paycheck Calculator Smartasset

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

North Carolina Paycheck Calculator Smartasset

Free Online Paycheck Calculator Calculate Take Home Pay 2022

New Tax Law Take Home Pay Calculator For 75 000 Salary

Here S How Much Money You Take Home From A 75 000 Salary

Tax Withholding For Pensions And Social Security Sensible Money

How Much Tax Is Deducted From A Paycheck In Nc

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow