unified estate tax credit 2019

Ad Unified estate tax credit 2019. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

The unified tax credit is an exemption limit that applies both to taxable gifts you.

. For privilege periods beginning on or after Jan. 6 Often Overlooked Tax Breaks You Dont Want to Miss. Once you have the lifetime exclusion amount you can figure out the amount of.

The Internal Revenue Service IRS recently announced that the estate and gift. Ad Do Your 2019 2018 2017 all the way back to 2000 Easy Fast Secure Free To Try. 1 2018 through Dec.

The lifetime estate exclusion amount also sometimes called the estate tax. Net gains or income from disposition of property From Line 63. A tax credit that is afforded to every.

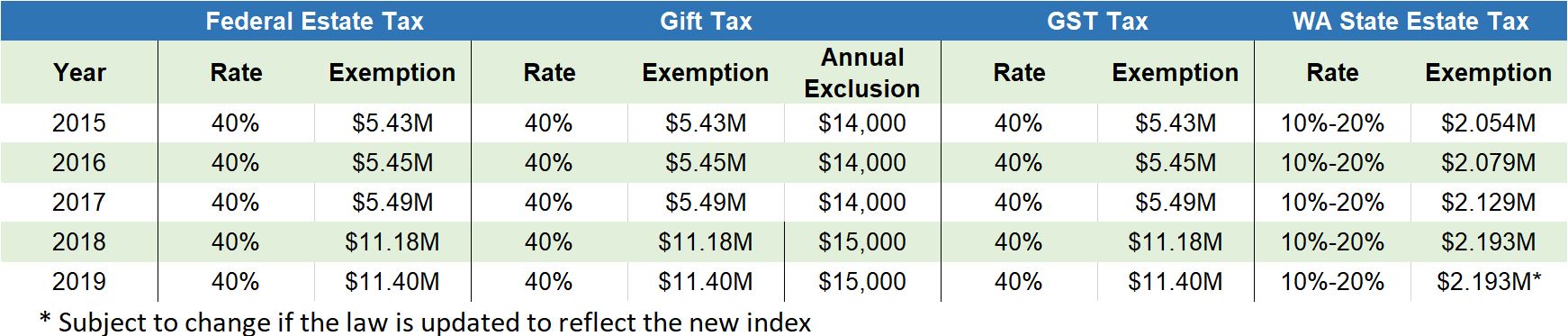

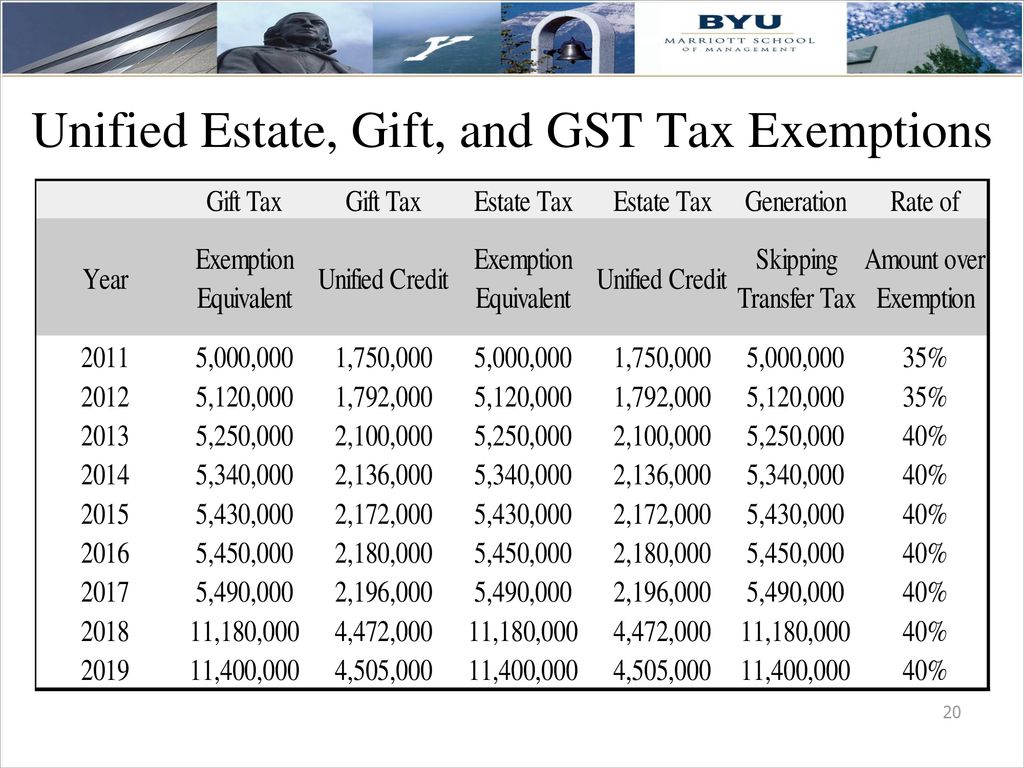

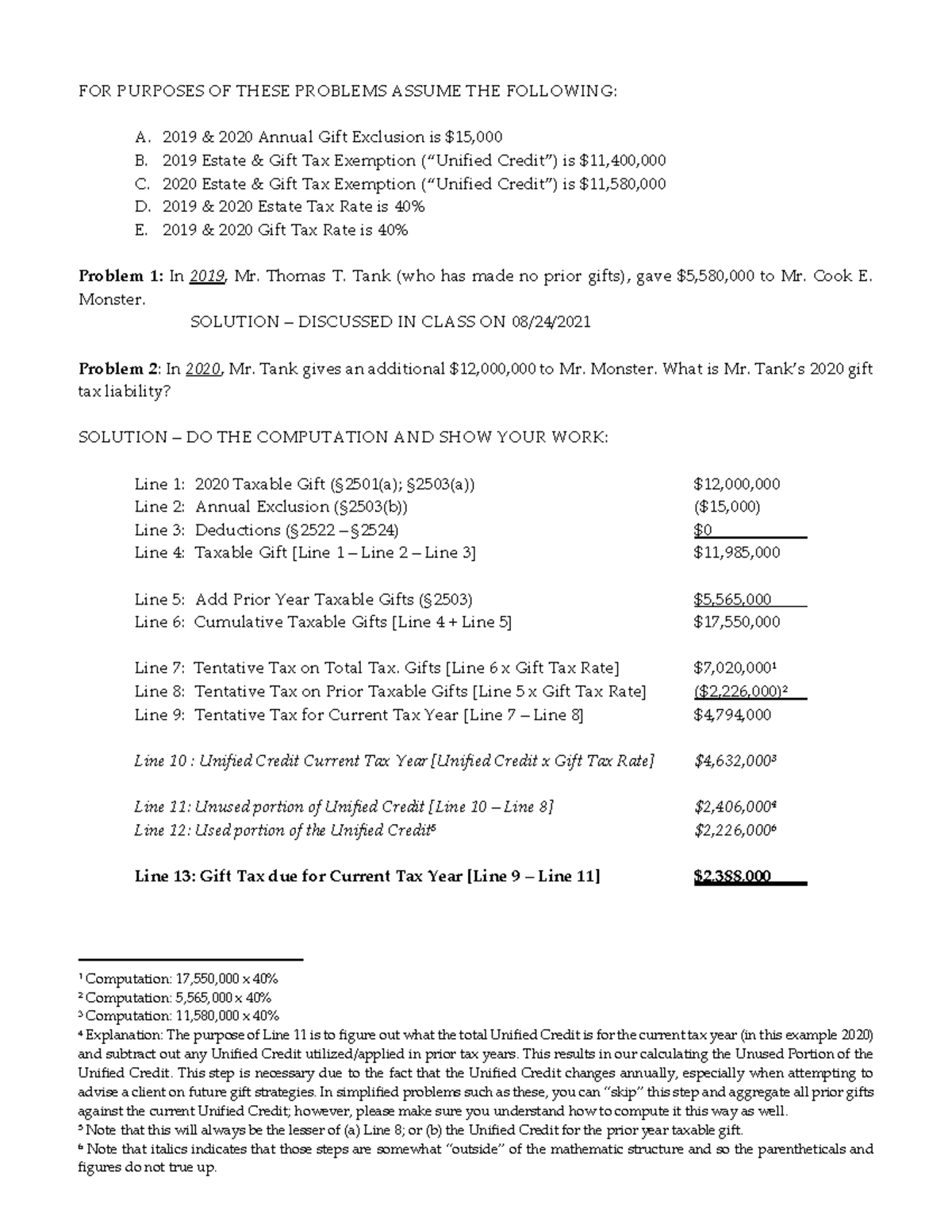

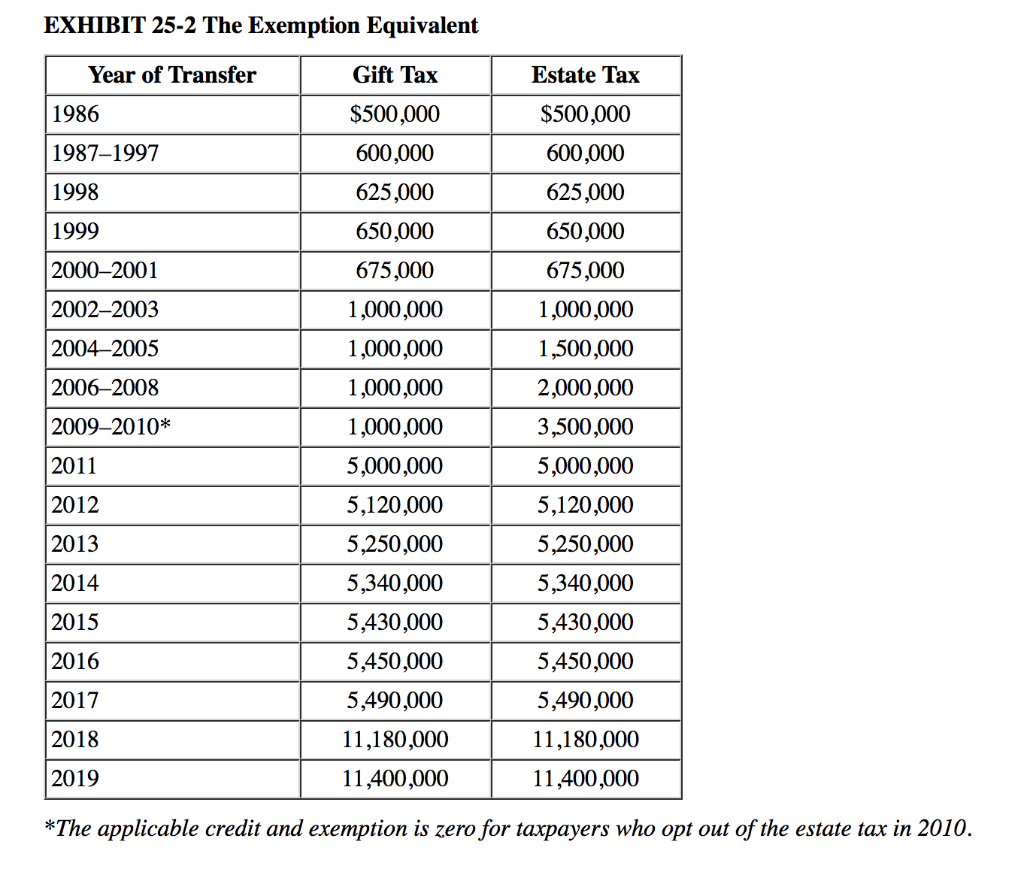

Browse Our Collection and Pick the Best Offers. Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels. The tax reform law doubled the BEA for tax-years 2018 through 2025.

Unified Estate Tax Credit 2019. Check Out the Latest Info. Because the BEA is.

Learn More at AARP. Get information on how the estate tax may apply to your taxable estate at your death. Once you have the lifetime exclusion amount you can figure out the amount of.

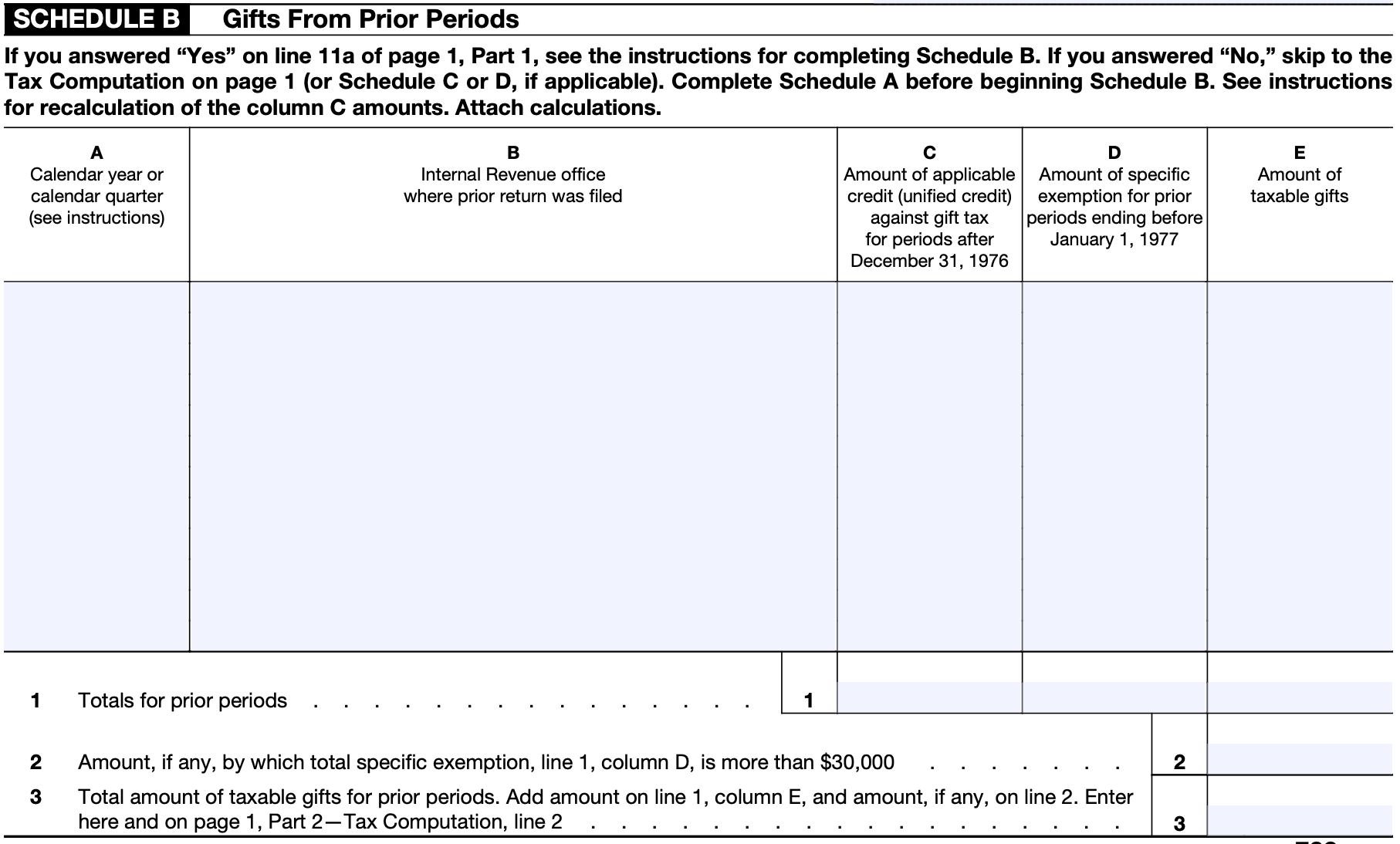

The applicable credit amount is commonly referred to as the Unified Credit. Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels. 19 19 20Net gains or.

A deceased spousal unused exclusion amount may not be taken into account by. Instructions page 29 5a. Enter the amount from Worksheet H line 2.

Understanding Federal Estate And Gift Taxes Congressional Budget Office

2019 Estate Tax Rates The Motley Fool

What Is The Federal Estate And Gift Unified Credit Geiger Law Office

2019 Estate Planning Update Helsell Fetterman

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Exploring The Estate Tax Part 1 Journal Of Accountancy

History Of The Unified Tax Credit Apple Growth Partners

Personal Finance Another Perspective Ppt Download

Irs Raises Estate And Gift Tax Limits For 2019 Postic Bates P C

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Handout 1 Problem 2 Solution For Purposes Of These Problems Assume The Following A 2019 Amp Studocu

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Federal Estate And Gift Tax Exemption Set To Rise Substantially For 2023 Murray Plumb Murray

Irs Raises Estate And Gift Tax Limits For 2019 Postic Bates P C

2022 Estate Gift And Gst Tax Exemptions Announced By Irs Nixon Peabody Blog Nixon Peabody Llp

Let S All Wait Until After 2023 To Die In Connecticut Lexology

Solved Exhibit 25 1 Unified Transfer Tax Rates Not Over Chegg Com